Learn more about AIM for Dallas and bcANALYTICS, and read the full 2017 State of Dallas Housing Report here.

If you missed the April 25th event, you can watch the presentation and panel discussion here.

Like many cities across America, Dallas struggles with how to provide adequate housing for low, moderate, and middle income households. The city’s history of segregation between the north and south is evident in many ways, as discussed in 2016 State of Dallas Housing. In regards to housing, a 2015 Supreme Court ruling on Fair Housing and the City’s Voluntary Compliance Agreement with The Department of Housing and Urban Development (HUD) have put the City under pressure to address historic segregation through their policies and funding allocations. Are opportunities for housing available to all residents, in the north and south? A holistic analysis of the city’s housing landscape is needed to help better understand current conditions and help shape housing policy to address the needs of Dallas.

The 2017 State of Dallas Housing is just that assessment of Dallas’ housing landscape - its current housing stock, the people that live in the city, activity to construct and sell new homes, and the policies that guide civic and market investments in housing.

Join [bc] for a presentation of the 2017 State of Dallas Housing report followed by a panel discussion on housing affordability in Dallas on Tuesday, April 25th, at 6:30 pm at the Dallas Black Dance Theatre. Panelist include -

Roy Lopez - Community Development Office, U.S. Federal Reserve Bank of Dallas

Bernadette Mitchell - Director of Housing, City of Dallas

Demetria McCain - President, Inclusive Communities Project

Scott Galbraith - Vice President, Matthews Affordable Income Development

Please RSVP here. Light refreshments will be provided.

Executive Summary

The 2017 State of Dallas Housing documents the characteristics of Dallas’ housing landscape - the people who live in the city, the houses they live in, and activity to build or sell homes - and identifies major barriers to accessing adequate housing for many of the city’s 1.3 million residents. In a city that has seen sustained increases in housing costs following the 2008 Recession, it appears that many low- and middle-income Dallasites struggle to find housing that meets their needs, regardless of whether they are looking to rent or own. Dallas’ surprisingly low homeownership rate (43%) continues to sit well below peers across the country, but this varies greatly between northern and southern Dallas as well as between the city’s white and minority households.

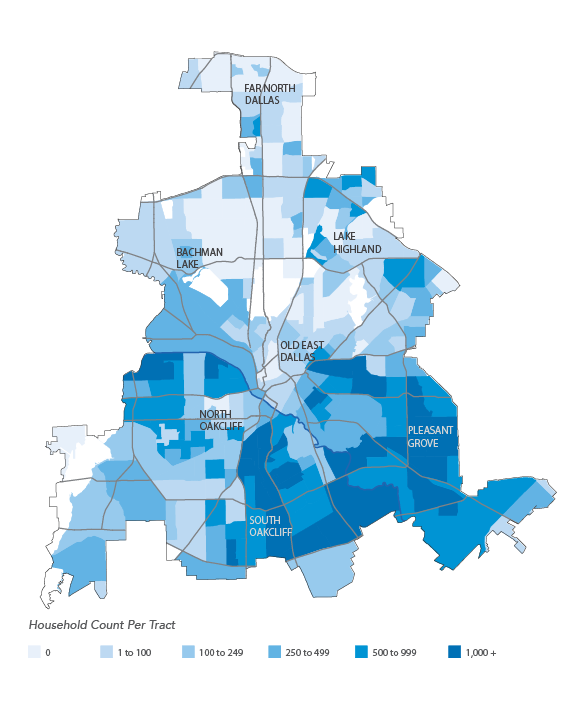

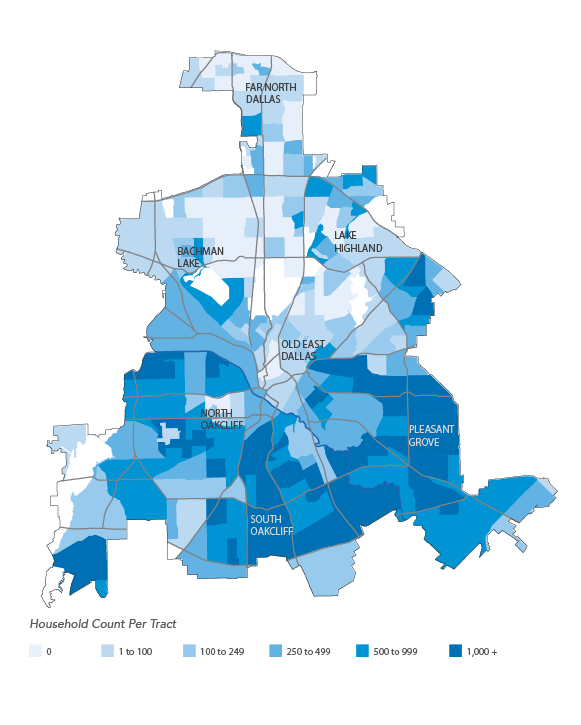

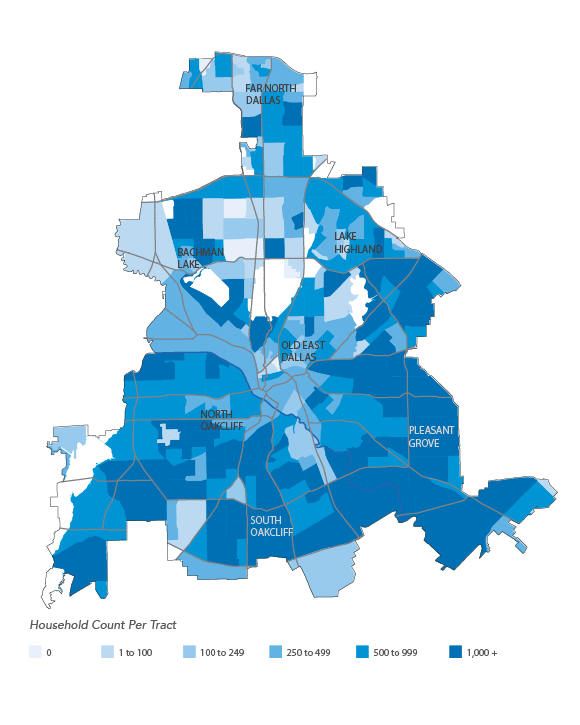

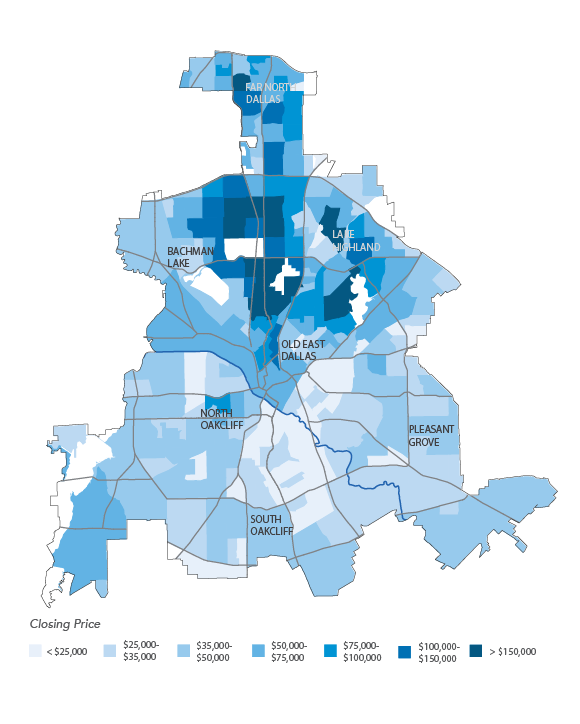

Dallas’ North-South divide permeates the report. Differences between households, housing, and market activity represent serious issues facing the city’s population. The city’s minority population is highly concentrated in southern Dallas and live in housing that is older and more affordable, although of varying quality, and those that live in northern Dallas are overwhelmingly renters. Opportunities to find affordable housing are limited in the north, often by economic constraints facing more than a third of the city’s households. Despite this, the local housing market operates at the high end of the income bracket, where homes are built and sold that far exceed the financial realities of most households in the city.

The findings in this report highlight the need for adjustments in public policy and reveal inefficiencies in the current marketplace. The recommendations of this report speak to those adjustments and inefficiencies, providing a pathway to building a more equitable city:

Key Findings

- 68,000 households in Dallas need housing that costs less than $400 per month;

- Homeownership for Dallas’ minority households falls behind rates of white households: 56% of white households are owner-occupied, compared to 31% for black households, 43% for Hispanic households, and 38% for Asian households;

- The median sale price of recently constructed homes rose from $145,00 in 2011 to $522,000 in 2016;

- 32% of homes in southern Dallas are valued less than $50,000, which represents just 6% of northern Dallas houses.

Recommendations

- The City of Dallas should undertake a thorough review of its Land Bank program;

- Innovative programs that promote housing affordability should be adopted by the City;

- Public/Private partnerships to expand market-rate affordable housing for middle-income homebuyers are needed across the City;

- Local homebuilders should explore opportunities for infill development of housing products that address the needs of low- and middle-income households identified in the report;

- The City should seek to further Fair Housing through all funding allocations, including HUD funding for single family ownership.

![[bc]](http://images.squarespace-cdn.com/content/v1/5248ebd5e4b0240948a6ceff/1412268209242-TTW0GOFNZPDW9PV7QFXD/bcW_square+big.jpg?format=1000w)